Federal tax taken out of paycheck

For example you may have no withholding tax taken from your paycheck due to how you filled out your W-4 form for the year. Also you may need to report Additional Medicare Tax withheld by your employer.

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Depending on your location you might pay local income tax and state unemployment tax as well.

. Not sure why your employer did not withhold any federal or state taxes from your paycheck. Calculating a level of tax withholding thats just right can sometimes take as much time as preparing your tax return. Most workers have money for taxes taken out of their paycheck including federal income tax and taxes for Social Security and Medicare.

California has the highest state income tax at 133 with Hawaii 11 New Jersey 1075 Oregon 99 and Minnesota 985 rounding out the top five. The TCJA eliminated the personal. Child Tax Credit - Tax credit of to 1000 per qualifying dependent child under age 17.

Find out with the experts at HR Block. Lets say you got a new job that pays 20hour. B Virginia decoupled from the CARES Acts changes to 163j but allows a state-defined deduction of 20 percent of the federal interest expense deduction.

Learn more about the different taxes on your paycheck including federal state social security and medicare withholding with the experts at HR Block. If youre self-employed though the form you. That works out to 800 per week 3200 per month and 41600 per year--pretax.

This can also be the opportunity to do a paycheck checkup and adjust tax withholding if you didnt have enough taken out in the previous tax year. The Withholding Form. According to some changes in the W-4 Employee Withholding Certificate find out more about that here earnings that are too low might not have their income taxes withheld at all.

A Utah does not provide an interest deduction under the individual income tax but instead offers a nonrefundable credit based on federal deductions which phases out at higher incomes. When it comes to Federal Income Tax FIT there are a few. Federal Tax Withholding Fed Tax FT or FWT.

The amount of tax that is withheld from your paycheck depends on the information you provide your employer with the W-4 form which you fill out when you begin employment for an employer. How Do You Calculate Your Federal Income Tax. However a new federal regulation has given officials a glimmer of hope in the fight against ghost guns.

Positions taken by you your choice not to claim a deduction or credit. How Much Money Gets Taken Out of Your Paycheck. Family or financial obligations might require that you bring home a bigger paycheck each.

The fastest and easiest way to make estimated tax payments is to do so electronically using IRS Direct Pay or the Treasury Departments Electronic Federal Tax Payment System. Coral Gables woman out more than 3000 after scammers trick her using Zelle Laura Hernandez says this all started when she received a text message from scammers. A federal income tax is a tax levied by the United States Internal Revenue Service IRS on the annual earnings of individuals corporations tr u sts and other legal.

North Dakotas maximum marginal income tax rate is the 1st highest in the United States ranking. The redesigned Form W-4 makes it easier for you to have your withholding match your tax liability. 1 online tax filing solution for self-employed.

Credit phase-out begins at 110000 for joint. H and R block. If no federal income tax was withheld from your paycheck the reason might be quite simple.

The federal withholding tax table that you use will depend on the type of W-4 your employees filled out and whether you automate payroll. You didnt earn enough money for any tax to be withheld. Under federal payroll rules employees are supposed to pay taxes by having them withheld from their earnings unless an exception applies.

Aug 24 Wage theft costing California workers an estimated 2 billion a year. North Dakota collects a state income tax at a maximum marginal tax rate of spread across tax brackets. Like the Federal Income Tax North Dakotas income tax allows couples filing jointly to pay a lower overall rate on their combined income with wider tax brackets for joint filers.

States and cities that impose income taxes typically have their own brackets with rates that tend to be lower than the federal governments. Employers have the option to use a computational bridge to treat 2019 or earlier W-4s as if they were 2020 or later W-4s specifically for tax withholding purposes. In 2017 Congress reduced the top corporate tax rate from 35 to 21 where it stands today.

Positions taken by you your choice not to claim a deduction or credit conflicting tax laws or changes in tax laws after January 1 2022. Self-Employed defined as a return with a Schedule CC-EZ tax form. It aligns with changes made by the 2017 Tax Cuts and Jobs Act TCJA.

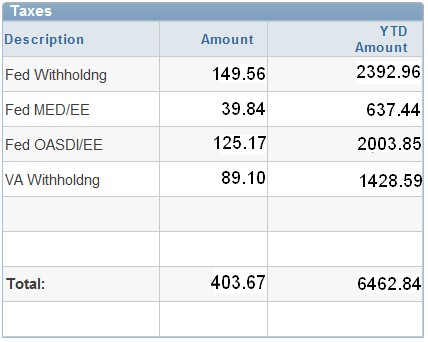

Keep in mind that many credits have income limits at which the credit cut off or phased-out. The amount withheld for income tax is determined by information on the employees W-4 form while Social Security and Medicare taxes use a flat rate. As you can see in the line chart below individual income taxes make up a much larger share of all federal tax revenues than corporate taxes do.

The estimated tax package includes a quick rundown of key tax changes income tax rate schedules for 2018 and a useful worksheet for figuring the right amount to pay. Your employer most likely takes federal income tax Social Security tax Medicare tax and state income tax out of your paychecks. For more information see Additional Medicare Tax under Social Security and Medicare Taxes.

If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block. But the IRS introduced a new Form W-4 beginning with the tax year 2020 that can simplify the process a bit. For employees there isnt a one-size-fits-all answer to How much federal tax is taken out of my paycheck However free online tax calculators and learning how payroll taxes work helps understand what take-home pay may look like.

But if you prefer to have more tax than necessary withheld from each paycheck you will get that money back as a refund when you file your tax return keep in mind though you do not earn interest on the amount you overpay. Americas 1 tax preparation provider. On the W-4 you let your employer know whether to withhold tax at the higher single rate or the lower married rate depending on your marital status.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The employers portion of both taxes is deductible on your Federal income tax return which can help to offset the sting of paying both parts of the Social Security and Medicare taxes. Federal Income Tax.

You may be required to pay Additional Medicare Tax. The share of federal tax revenue paid by corporations has declined substantially over time. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

One personal exemption of 000 may be taken as a deduction from your gross pre-tax income for yourself if you are.

Here S How Much Money You Take Home From A 75 000 Salary

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

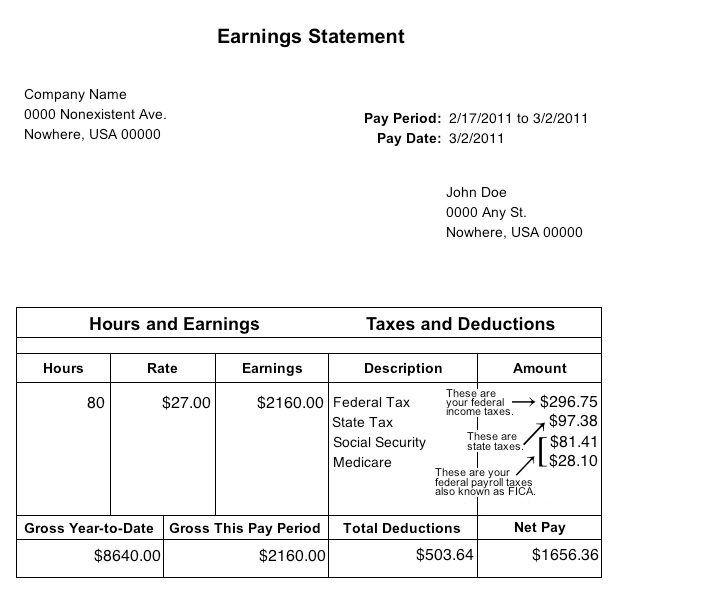

Pay Stub Meaning What To Include On An Employee Pay Stub

Check Your Paycheck News Congressman Daniel Webster

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Taxes On Paycheck On Sale 54 Off Www Ingeniovirtual Com

Understanding Your Paycheck

Irs New Tax Withholding Tables

Taxes On Paycheck On Sale 54 Off Www Ingeniovirtual Com

Different Types Of Payroll Deductions Gusto

Understanding Your Paycheck Direct Deposit Advice Jmu

Understanding Your Paycheck Youtube

Understanding Your Paycheck Credit Com

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Taxes Federal State Local Withholding H R Block

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age